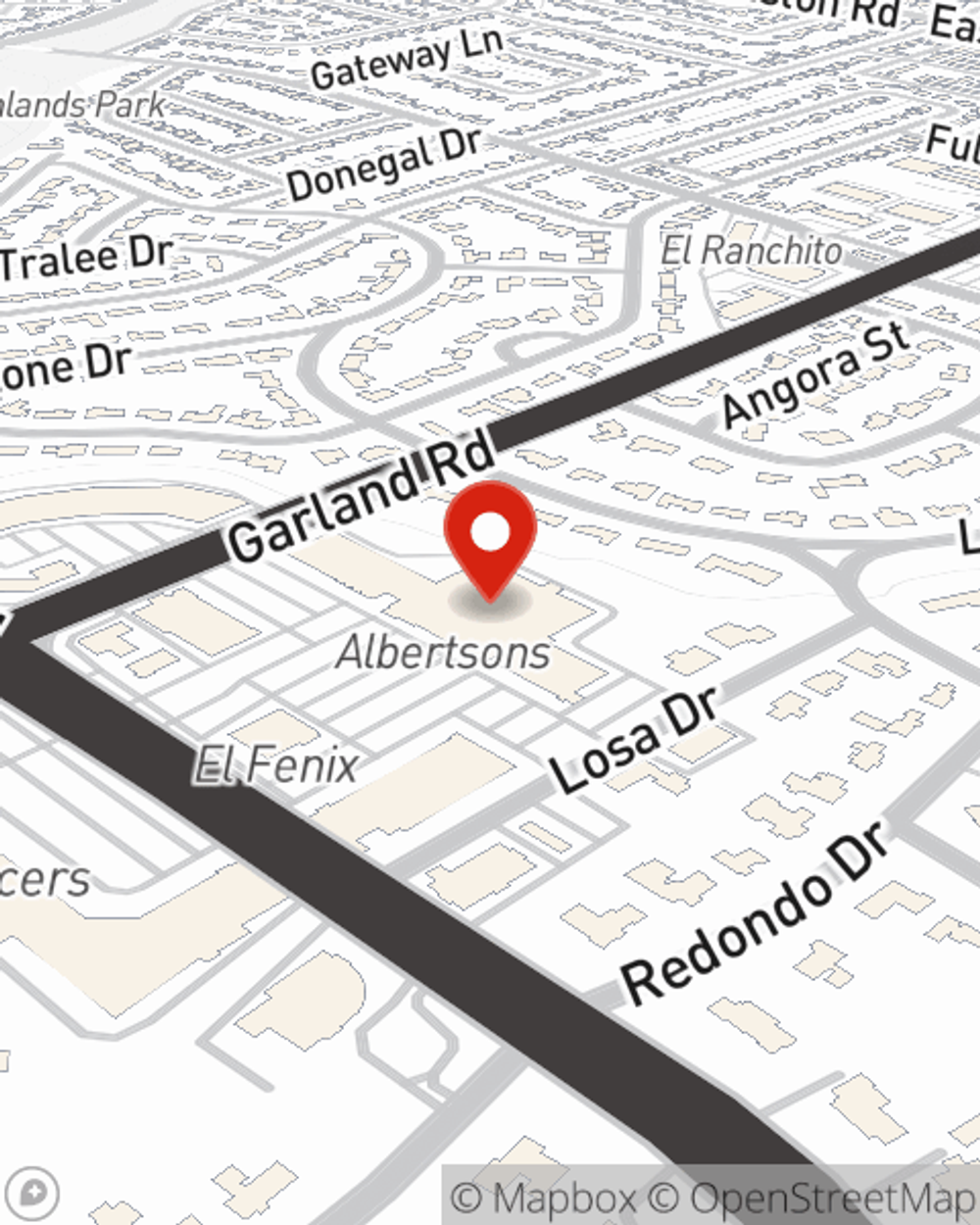

Business Insurance in and around Dallas

Looking for small business insurance coverage?

Cover all the bases for your small business

- Dallas County

- Tarrant County

- Collin County

- Denton County

- Rockwall County

- Dallas

- Lakewood

- Highland Park

- White Rock Lake

- Richardson

- Lake Highlands

- University Park

- Casa Linda

- Frisco

- Plano

- Mesquite

- Garland

- Sunnyvale

- Forney

- Seagoville

- Forest Hills

Cost Effective Insurance For Your Business.

Whether you own a a HVAC company, a bakery, or an art gallery, State Farm has small business protection that can help. That way, amid all the various options and decisions, you can focus on making this adventure a success.

Looking for small business insurance coverage?

Cover all the bases for your small business

Strictly Business With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Mark Nesselroad. With an agent like Mark Nesselroad, your coverage can include great options, such as artisan and service contractors, commercial liability umbrella policies and commercial auto.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Mark Nesselroad is here to help you review your options. Get in touch today!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Mark Nesselroad

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.